Credit Builder Loans

Build installment credit and savings.

Our credit builder loan reports $1,000 to $2,500 of installment credit to the credit bureau. Choose between building credit history with a low monthly payment or building credit and savings with slightly higher monthly payments.

How it Works.

Open your credit builder account in just minutes.

No credit check

Choose your plan.

Choose your plan: ‘Build Credit’ to build credit with a low monthly payment or ‘Build & Save’ to build savings and credit.

Make on-time monthly payments to build positive credit history.

Access to our Personal Financial Management tool, to help you with budgeting and debt management.

Get your accumulated funds once the account is paid off or closed.

Cancel anytime after the first 12 months without penalty or keep open to build a long-term credit history.

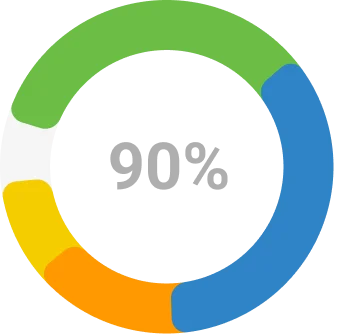

A credit builder account can positively impact factors that determine 90% of your Credit Score

- Payment History (35%)

- Credit Utilization (30%)

- Length of History (15%)

- Credit Mix (10%)

What is a Credit-Builder Loan?

A credit-builder loan holds the amount borrowed in a bank account while you make payments, building credit. You will choose an amount that comes with an interest rate, a term (the length of the loan in months or years), and a set monthly payment.

The monthly payment is split between interest and repayment of the money borrowed (principal). The payment split includes more interest at the beginning of the loan and more principal near the end. A car loan or home mortgage are common types of installment loans.

Read More

How will credit builder loan help me?

Credit builder Loan creates installment credit on your credit profile. This demonstrates to lenders your ability to consistently make on-time fixed monthly payments over the term of a loan.

A credit builder loan can help you build installment credit and demonstrate to lenders your ability to consistently make on-time payments over the term of a loan. Our credit builder laon let you pick the monthly payment, credit amount, and account term that’s right for you. On-time payments, the amount of credit, and the length of credit history are 3 key components that impact 80% of your credit Score.

Read MoreOur credit builder loan compliments other credit products.

Your credit mix matters – having a diverse blend of credit accounts builds your profile. Adding a Revolv account to Instal can enhance your credit mix.

Your credit mix matters – having a diverse blend of credit accounts builds your profile. Adding a credit builder loan to a revolving credit can enhance your credit mix. Credit mix is the number and type of accounts (installment or revolving) on your credit profile which impacts 10% of your Credit Score. You should have a mix of revolving and installment accounts to optimize your profile.

Read More

Step 1:

Choose your account type.

Step 2:

Select the plan that’s best for you.

Most Affordable

$ 15 / mo

- $1,000 installment account reported

- Lowest cost Instal account available

- Build up to 120 months of payment history

- Cancel anytime with no penalty

$30 / mo

- $2,500 installment account reported

- Increases amount of credit reported

- Build up to 120 months of payment history

- Cancel anytime with no penalty

Most Affordable

$38 /mo

- Save up to $1,100 in just 36 months

- $1,100 installment account reported

- Build 36 months of credit history

- Cancel anytime with no penalty

$48 /mo

- Save up to $1,000 in just 24 months

- $1,000 installment account reported

- Build 24 months of credit history

- Cancel anytime with no penalty

$96/ mo

- Save up to $2,000 in just 24 months

- $2,000 installment account reported

- Build 24 months of credit history

- Cancel anytime with no penalty

How soon can my credit score go up?

Your credit profile and your associated credit score are uniquely you. How quickly your credit profile improves and the impact on the score will vary, but the best thing you can do is make on-time payments and keep building your profile.

Could this negatively impact my credit score?

Occasionally, adding a new line of credit to your credit profile will cause a slight temporary dip in your credit score because it may reduce the overall age of your credit history. In this case, it’s typical for your credit score to quickly rebound and increase with on-time payment history for the CreditStrong account loan.

Can I cancel at anytime?

Occasionally, adding a new line of credit to your credit profile will cause a slight temporary dip in your credit score because it may reduce the overall age of your credit history. In this case, it’s typical for your credit score to quickly rebound and increase with on-time payment history for the CreditStrong account loan.

You may cancel or close your CreditStrong account at any time with no prepayment or early termination fee. Please note that any payments received more than 30 days late will be reported as ‘late’ to the credit bureaus.

When canceling or closing your account you should be aware that payment history is the most important factor for your FICO credit score and by closing your account early you will reduce the number of payments reported to the credit bureaus, potentially reducing the positive impact of the CreditStrong Account loan on your credit score.