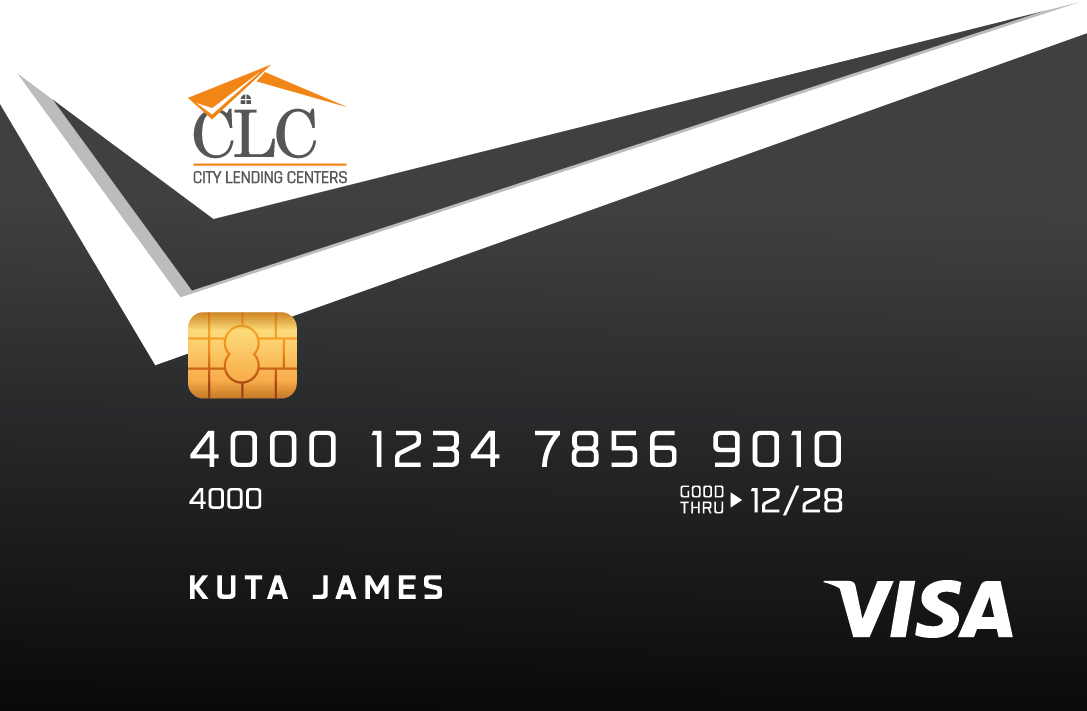

Guaranteed Secured Visa

- The interest rate is 16.99%

- Credit Limit from $300 – $25,000

Cash Back Reward Program coming soon.

Key features and benefits

We offer a secured credit card that works like any other card that helps build credit. CLC’s secure credit card will help customers create new

credit or rebuild damaged credit. The only difference between CLC’s credit card and regular credit card is that clients pay an upfront deposit to

secure their credit limit. CLC reports all payments to credit bureaus similar to the bank’s process, and clients will be

expected to make their monthly payments promptly.

A secured credit card is a type of credit card that is backed by a cash deposit from the cardholder. This deposit acts as collateral on the account, providing the card issuer with security in case the cardholder can’t make payments. With a secured credit card, the amount that you put down in a deposit will become your credit limit for your credit card.

Build credit

There are many factors that contributes to your credit rating. Payment history is one of these factors, paying your credit card on or before the due date will help improve your credit rating.

Shop and pay online

Use it as you would any credit card: shop online, pay bills, and set up accounts online.

Flexible and convenient

Spend up to your deposit limit with the convenience and flexibility of a credit card.

Pay for what you use

You’ll only pay monthly interest when you carry a balance on your Secured Visa.

Pay on time

Paying your credit card in a timely manner will improve your credit score.

Set your own limit

Your limit is set at your deposit amount and can range from $200 to $25,000.

Purchase Security

Insures eligible items against theft or damage for 90 days from the date of purchase.

Worldwide acceptance

Visa offers a secure and reliable method of payment in 200+ countries and territories.

Benefits of a secured card

Prepaid cards can provide some of the convenience of a credit card,

but there are differences between prepaid and the City Lending Centers Secured Visa.

CITY LENDING CENTERS

SECURED VISA

- Can improve your credit rating

- Control spending limit with the amount of your deposit

- Accepted wherever you see the Visa logo

PREPAID CREDIT CARD

- It does not improve your credit rating

- Needs reloading once the balance is depleted

- Not accepted by all merchants

Request a call back.

One of our Credit Specialists will reach out to you within 24 hours.

I would like to discuss: